WASHINGTON — The Trump Organization, the family real estate interests of presidential son-in-law Jared Kushner and Trump friend Richard LeFrak, a New York developer, could all benefit from a new federal program that has designated "opportunity zones" in "economically distressed" areas around the country and offers tax benefits for developers.

Kushner's family already owned real estate on the Jersey Shore, but spent an extra $13.15 million in Long Branch after the area was deemed an opportunity zone by the Treasury Department in April according to Bloomberg News. The Trump Organization was already planning a hotel redevelopment in Greenville, Mississippi, with a partner, but that project is in an area that was declared an opportunity zone in April and could now be eligible for the tax break.

The Trump Organization's partner in Mississippi, Suresh Chawla, told NBC News his firm was unaware of the designation and not planning to participate.

Kushner also has existing properties in two Maryland opportunity zones, while the Trump Organization owns a New Jersey golf course inside another. Kushner's family company and the Trump Organization did not respond to requests for comment.

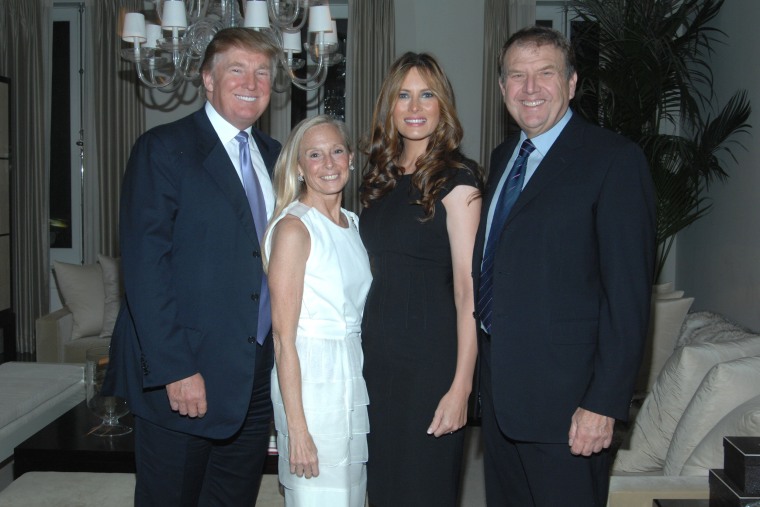

Richard LeFrak has a $4 billion, 183-acre massive development called SoLe Mia in North Miami that is now right in the middle of a zone. As a new project it could also qualify. Lefrak's spokesperson did not respond to a request for comment. LeFrak is a longtime associate of Trump's who has spent time with him at Mar-a-Lago. According to the New York Times, Trump asked LeFrak to build the border wall.

President Donald Trump will tout the program in an event to be held at the White House Wednesday.

The program, created by the 2017 tax bill and run by the Treasury Department, allowed state governors latitude to name 8,700 areas as opportunity zones. All the zones were certified by Treasury in April 2018. The excitement in the investor community has been balanced by a growing unease among housing and economic development experts that the program lacks government oversight.

A White House spokesperson told NBC News that reporting requirements are a work in progress. The spokesperson said a new council headed by HUD Secretary Ben Carson will determine “what data and by what means it can be collected and analyzed to measure the success of Opportunity Zones.”

For its part, the Chamber of Commerce has been enthusiastic about the program, "This program is another way tax reform delivered on its promise to create jobs and improve lives for all Americans," said Chamber Vice President Caroline Harris in an emailed statement to NBC News. "The Chamber is strongly encouraged by recent regulatory guidance and looks forward to continue working with Treasury to maximize economic growth potential from this initiative."

Now that Treasury has certified the zones, developers are encouraged to plow their capital gains into those neighborhoods. Investors pay reduced rates on capital gains invested in the zones, and can qualify to have capital gains realized within the zones exempt from taxes altogether.

Real estate experts are already seeing a bump in some property values.

Critics have noted that some of the designated zones were already on the upswing, and they say a generous program meant to steer billions to low-income neighborhoods might instead concentrate investments in gentrifying communities like Brooklyn and Miami.

For example, a two-bedroom condo in Brooklyn Heights with a private garden selling for more than $700,000 is in a zone and — according to the Treasury — in an "economically distressed" community. The median home sale price in Brooklyn Heights, which is one subway stop from Manhattan's Financial District, is now more than $2.3 million, according to Trulia.

The tax legislation said that only census tracts with poverty rates at 20 percent or above could qualify. But almost a fifth of the zones were certified by the Treasury Department through provisions that allowed wealthier zones to be designated, according to an analysis by the Brookings Institution.

As a result, some zones are in places not usually associated with the phrase "economically distressed," such as downtown Charleston, South Carolina, or a zone in West Palm Beach.

The latest figures show $15 billion in new investments is already anticipated.

"I think the whole thing is painting a picture of a program which will benefit areas that are already attracting investment capital," said Jim Costello, an economist for Real Capital Analytics, a firm that has run a baseline analysis on existing development in the zones.

The zones were chosen by state governors with wide discretion. Only 25 percent of eligible zones got the nod. For example, in Kentucky seven of the 18 poorest census tracts in Louisville were not chosen, according to Tim Weaver, an assistant professor at SUNY Albany who wrote a book on the effectiveness of Empowerment and Enterprise Zones.

"If the key goal was to reduce poverty this was not the proper vehicle," said Weaver. "It's like opening a fancy restaurant and giving the leftovers to the poor."

The Kentucky Cabinet for Economic Development shared a statement with NBC News saying to select their state's zones they used a mapping tool and formally invited input from local stakeholders for consideration.

In Maryland, a spokesperson for Gov. Larry Hogan said the governor's office received suggestions from 12 counties as well as local officials and developers. The spokesperson said all of the state's zones are low-income.

In New Jersey, "the selection of the zones was done through an objective, transparent and rigorous process based on a formula," said a spokesperson for Gov. Phil Murphy, adding that the governor's office weighed income, unemployment rates and existing neighborhood investments.

Current property owners in zones might also see a boost in property values, "The owners of these assets might see a bit of a windfall even if they do not go through the whole process to redevelop and deploy capital from a qualified fund themselves," says Costello. "Suddenly the assets may look a little more valuable given the fact that there are more potential buyers looking at these areas."

The Kushner family and the Trump Organization can't take direct advantage of the tax break for the properties they owned in New Jersey and Maryland before the tax bill passed. However, if they had pre-existing permits to build a new development on the property, then they could start an opportunity zone fund to build and operate the building and that structure could qualify, according to tax experts.

For outside investors, property inside the zones may become more attractive.

For example, an investor could build a new restaurant on Trump's golf course as a separate business and that could qualify.

"This is a way to avoid having to ever recognize gain on an accretion of wealth," said Jay Darby, a tax expert from the Sullivan and Worcester law firm, at an investor forum. "It's a huge deal. It's not a big deal, it's a huge deal."

The legislation includes no guarantees that the investments will benefit the community. For example, Adam Looney, a senior fellow in economic studies at Brookings, says the rules would permit an investor to buy 500 acres that had an outhouse on it, double the value of the outhouse and thus qualify the investment as a tax shelter.

Critics say program lacks reporting requirements

For their part, Trump administration officials are maintaining extreme optimism.

Treasury Secretary Steve Mnuchin expects $100 billion in new investments, according to an agency press release. "We want all Americans to experience the dynamic opportunities being generated by President Trump's economic policies," Mnuchin said.

HUD Secretary Carson is so confident he often raises the opportunity zone program as a solution to the affordable housing crisis.

At a March hearing, when Carson was asked about a lack of ongoing repairs to crumbling public housing, he responded by talking about the tax benefit. "You are able to actually pool this capital and that will work extremely well," he said. "And we will already be involved in HUD with many of these redevelopment programs and will be able to guide that funding."

But there's no indication the government will collect or publish who is investing, what kind of investments are taking place or who the program will impact, according to the Treasury Department, the legislation does not require it.

"I'm taking a wait-and-see attitude," said Terry Beach, economic development director for St. Clair County, Illinois, which includes the economically depressed city of East St. Louis. Zones in his county will compete with zones in neighborhoods in Los Angeles and New York. Beach said he recently met with a White House staffer to pitch ideas as to how the program could benefit residents who live in the zones as well as the businesses who invest.

Some low-income housing advocates are doubtful, "Unless the Treasury Department quickly establishes regulatory guardrails, there is no guarantee that low-income people will benefit in any significant way — if at all — from opportunity zones," said Diane Yentel, president of the National Low Income Housing Coalition.

Sen. Cory Booker, D.-N.J., says the bill was supposed to have reporting requirements.

Booker wrote the original bill with Sen. Tim Scott, R.-S.C., which called for annual data to be collected on the program starting five years after the bill passed.

"As a result of the rushed partisan process to pass the Republican tax bill last December, critical safeguards included in the underlying legislation were dropped," the senator said in a statement emailed to NBC News. "Now [the Treasury Department] must restore and expand upon those guardrails and transparency measures included in the underlying legislation. … [W]e need some basic levels of transparency and reporting."

Treasury is expected to propose a second set of regulations in the coming months.

A Treasury official tells NBC News that a regulatory hearing on the program is planned for Jan. 10. "We will carry out the same careful and expeditious process for the second set of proposed regulations," said the official.

But Booker is not confident Treasury will put the reporting requirement back in and if Treasury doesn't act, he says he will introduce legislation to fix the bill.

Tax lawyers have already found a workaround to one of the program's few restrictions.

The bill rules out "sin" businesses like liquor stores, massage parlors and tanning salons but according to tax experts, there's currently nothing to stop an investor from building or renovating a structure and renting to those businesses. That means a low-income neighborhood chosen as a zone could now be dotted with a new smattering of undesirable storefronts.

"These funds should be accountable for what happens in these communities," said Lori Chatman, senior executive vice president of Enterprise Community Investment, a developer of affordable housing. "We are giving up something as taxpayers — we feel like we should have the benefit of understanding how communities are benefiting from that and right now there is no reporting."

A White House spokesperson told NBC News, "Treasury and the White House are still working through all the implementing regulations for Opportunity Zones. We understand the intent of the legislation and will continue to work through these types of details."

The governor of Mississippi did not respond to requests for comment.