A week ago, the Senate passed its tax bill, which featured large permanent cuts for corporations along with temporary tax breaks for individuals and private businesses. But the bill also contained significant last-minute changes, and experts are still working out its implications as the House and Senate prepare to negotiate a final deal. We talked to tax experts and looked at the latest independent analyses to game out some of the early winners and losers.

WINNERS

The rich

Despite the president's repeated claims to the contrary, the biggest gains in the tax bill go to wealthy individuals, heirs and business owners.

The Senate bill raises the threshold on the estate tax, which currently only applies to the top 0.2 percent of inheritances, and raises the income threshold on the top tax rate, which is also lowered from 39.6 percent to 38.5 percent. The rich are more likely to benefit from changes to pass-through income as well.

Overall, 62.2 percent of the Senate's tax benefits would go to the top 20 percent of households in 2019, according to an analysis by the nonpartisan Tax Policy Center, with 15.3 percent going to the top 1 percent. The share going to the top 1 percent would rise over time to 62.1 percent in 2027 as inflation reduces some middle-class benefits and temporary changes expire, although supporters claim they would be renewed.

Corporations

The crown jewel of the Senate bill, just like the House bill, is a major reduction in the top corporate tax rate from 35 percent to 20 percent.

Senate Republican leaders faced pressure to retreat from the 20 percent number in the run-up to final passage in order to preserve or add tax benefits elsewhere. The White House has since signaled it might be open to a higher 22 percent rate, but conservative anti-tax groups are pushing lawmakers hard to stick to 20 percent.

There are also potentially big benefits for companies with international holdings. Many corporations defer bringing profits from abroad back into the United States, since they avoid paying taxes on them until they do. The bill switches to a new territorial tax system in which the companies would have to pay taxes on foreign earnings, but at a much lower rate of 14.49 percent on liquid assets and 7.49 percent on revenue that's been reinvested.

That could be a boon for a company like Apple, which has major assets parked abroad. Richard Harvey, a tax professor at Villanova University who has testified before the Senate on Apple's tax affairs, estimates the tech giant would save $47 billion in taxes versus the cost of repatriating profits under current law. The estimate was first published in the Financial Times.

Other multinational corporations that stand to gain from the foreign tax changes under Harvey's calculations, which are based on company financial statements, include Pfizer, with $36 billion in potential savings; Microsoft, with $28 billion; and Google, with $15 billion.

"There's also provisions to make it more difficult to shift income overseas…but the U.S. multinationals are still excited about the reduced corporate tax rate coupled with a territorial system," Harvey said in an interview. "The benefits significantly outweigh the others."

One potential downside for corporations in the Senate bill is that it both maintains the corporate alternative minimum tax and keeps it at the new corporate tax rate of 20 percent. The alternative minimum tax limits deductions and credits, and could affect tech companies in particular, since they make extensive use of the research and development credit. But the AMT provision appears to be an oversight caused by the Senate's last-minute drafting process and it's likely to be changed in any final bill.

Pass-through businesses

The bill creates a new 23 percent deduction for pass-through income, which affects many businesses ranging from small retail stores to large real estate companies like those owned by President Donald Trump. The deduction was expanded at the last minute under pressure from Republicans like Sen. Ron Johnson, R-Wisc., who initially withheld support for the bill.

The biggest winners would be the wealthiest recipients. But the new deduction could also be a boon for independent contractors, S corporations, and LLC's that pull in under $500,000 for joint filers and $250,000 for single filers and would face looser restrictions on who can take the deduction.

This new pass-through deduction would also create a gigantic incentive for business and employees to reclassify their income to qualify for the benefit, which could lead to major legal battles over eligibility long into the future. That cuts against Republican promises to make filing taxes simpler.

"It would be trench warfare, and with every taxpayer," said Daniel Hemel, a professor at the University of Chicago. "If you can get into independent contractor status, then that's great. Your tax life will become more complicated, but your bill will go down."

LOSERS

Middle and low-income households

Loser is a relative term here. Almost all households would see a tax cut immediately if the Senate tax bill passed. Only 7 percent would see an increase in 2019, according to the Tax Policy Center analysis.

But the gains would be muted for the lower half of the income ladder — the bottom 20 percent of households would receive an average cut of just $40 in 2019. And they're dwarfed by the benefits for the richest households and corporations.

The effective tax rates would also increase over time if its benefits expire on schedule and the bill's switch to less generous inflation measures eat into gains. By 2027, 47.5 percent of all households would pay more in taxes than under current law, including 62.2 percent of taxpayers in the middle 20 percent of earners.

"Overall the vast majority of taxpayers will get a tax cut for a period of time," Harvey said. "Then the tax cut will disappear, the pass-through (cut) will disappear, and the corporate tax cuts will remain permanent."

Many lower-income households don't pay income tax already, meaning they would only benefit from tax breaks that are refundable against their payroll taxes. These are not a significant feature of the Senate tax bill. Sens. Marco Rubio, R-Fla., and Mike Lee, R-Utah, pushed to cut the corporate tax rate to 20.94 percent instead of 20 percent in order to make a greater portion of the bill's child tax credits refundable, but their amendment failed.

Deficit hawks

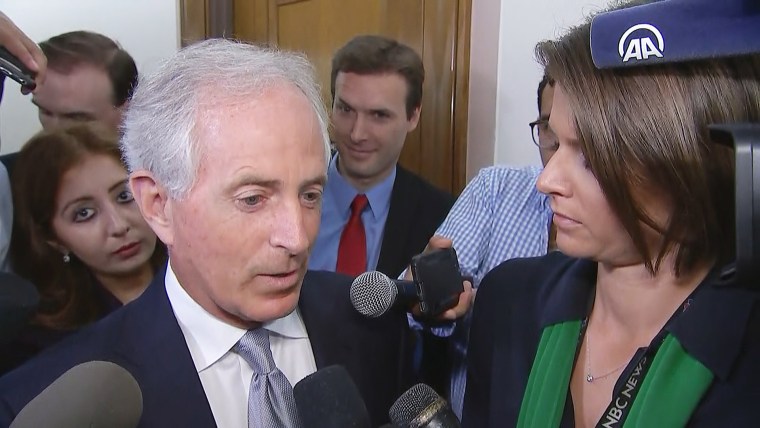

The lone GOP defection on the tax bill, Sen. Bob Corker, R-Tenn., came over deficit concerns. While the White House and top GOP leaders claim the bill will produce enough growth to pay for itself, nonpartisan analyses inside and outside of government say it will add hundreds of billions of dollars in debt.

Congress' own Joint Committee on Taxation predicts it will add about $1 trillion to deficits over the next decade, even factoring in economic effects. That number could be understating the cost, since Republicans also say they plan to renew measures that expire under the bill, reducing its cost on paper. Some Republican senators pushed to include measures that would claw back some of the bill's benefits if the deficit grew more than expected, but discovered that Senate rules prevented them from including them.

Blue States

Like the House bill, the Senate tax bill helps pay for its cuts by limiting the deduction for state and local taxes to $10,000 of property taxes. Most Americans will take the standard deduction, which is increased under the tax bill to $12,000 for single filers and $24,000 for joint filers, so they won't notice the difference. But the most affected group are upper-middle class and high-income professionals in places with higher taxes and higher cost of living, which disproportionately includes residents in blue states like New York, New Jersey and California.

Unions and social services

Related to the state and local tax deduction change, public service unions could lose out as the bill reduces incentives for state and local governments to spend. This could also affect lower-income residents in high-tax states even if they don't pay more in taxes, since it could put pressure on state governments to cut spending on social services.

Obamacare

The bill eliminates the individual mandate, which requires Americans who go without insurance to pay a penalty. The Congressional Budget Office estimates that the move would save $338 billion, which is used in the bill to finance its corporate and individual cuts. But that's because the CBO also predicts 13 million fewer people would have insurance after 10 years, and many of them would leave benefits from health care subsidies or Medicaid on the table. In addition, the move would raise premiums by 10 percent on individual plans.

A key GOP vote, Sen. Susan Collins, R-Maine, backed the measure under the condition that the Senate also pass a bipartisan bill to help stabilize insurance markets. But the House and the White House have so far shown no interest in including the measure, putting her vote on a final bill in doubt, and experts are skeptical it would counteract the disruption caused by the mandate changes.